The field of finance is ever-changing and also the introduction of modern technology, it is constantly modify quickly. The digitization of cash has not yet only created transactions faster but has additionally transformed the traditional economic facilities on its go. Using this evolution, Retik Fund has come up with a means to take economic professional services, especially business banking, to a new degree. This post strives to learn the way forward for finance and the way Retik is spearheading this interference.

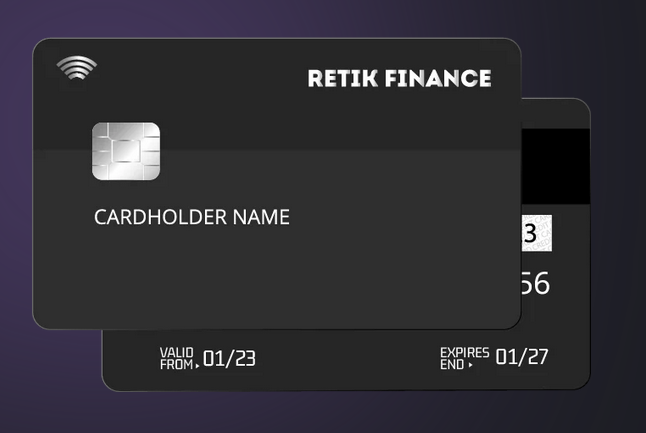

Retik Financing is actually a Nigerian-centered FinTech organization using a pursuit to encourage Africans financially by offering usage of economic providers that had been once not available or unsuitable. The company brings together Open Consumer banking, Synthetic Knowledge, and Blockchain Technologies to produce a program that offers excellent monetary professional services to the people who traditionally will not have use of financial. Retik Finance operates such as a virtual lender that permits people to open balances, take away and put in income, pay out bills and get personal loans between other solutions.

One of the crucial features of Retik Fund is its utilization of blockchain technology. With over forty-three million unbanked grownups in Nigeria, one of the biggest issues that the land confronts is usage of economic solutions. A majority of the populace lacks use of conventional consumer banking solutions, possibly caused by a absence of identification or even the prohibitively substantial costs of keeping bank accounts. Retik Financial utilizes blockchain modern technology to make protected and transparent economic solutions which render it simple and reasonable for accessibility consumer banking professional services.

One more area that Retik Financial is interfering with classic consumer banking is through the use of Artificial Knowledge. The AI technology makes it possible for the organization to personalize its fiscal services and products to specific consumers. Retik Financial leverages AI to understand consumer behavior, keep track of consumer spending designs, expenses monthly payments, savings, among other monetary pursuits. This enables the organization to provide its solutions dynamically, catering to each user’s financial requirements.

Retik Financial also serves small companies in Nigeria. Small, and moderate-scaled businesses normally find it difficult to get funding from conventional financial institutions as they do not have enough collateral or satisfy the tough qualifications requirements set up by these establishments. Retik Fund, however, methods this in another way. By benefiting the fintech firm’s AI-powered chance examination techniques, small companies will get cost-effective lending options to develop their organizations with out dealing with the conventional consumer banking software anxiety.

Retik Fund is not merely disrupting the conventional business banking room in Nigeria, yet it is also establishing the speed for fintech firms across Africa. As a result of its disruptive strategy, the business has earned many awards for example the African Fintech Pioneer Prize and the Africa Innovating for Advancement Honor. The way forward for financing is definitely bright, and Retik Fund is at the forefront of this emerging trend.

short:

As technology is constantly progress, it can be apparent that the world of finance continues to progress with an unparalleled tempo. Retik Finance’s revolutionary procedure for business banking has revolutionized the regular financial room and showed usage of monetary services which were once inaccessible to lots of people. The company’s utilization of blockchain, Man-made Intelligence, and also other impressive technologies has transformed the consumer banking market, providing people with entry to business banking services they must obtain their economic targets. The future of fund is without question bright, and with Retik Fund paving how, we can anticipate more disruptive enhancements to alter the game inside the fintech industry.